The year 2025 represents a significant inflection point in Canada’s home energy incentive policy. A period defined by a single, comprehensive federal grant is drawing to a close, giving way to a more fragmented, dynamic, and geographically nuanced landscape of financial incentives.

This shift requires a new approach for homeowners and industry professionals alike, demanding a deeper understanding of program-specific criteria, shifting deadlines, and the emergence of innovative financing models.

The Federal Rebate and Loan Framework: The End of an Era and the Dawn of a New One

The foundational pillars of federal home energy grants are undergoing a profound transformation. While the Canada Greener Homes Grant (CGHG) has been a cornerstone of home retrofits for years, its chapter is now closing. This conclusion is not an abrupt termination but a strategic pivot, with federal resources being reallocated to new, highly targeted initiatives and existing loan programs.

The Final Countdown: The Canada Greener Homes Grant (CGHG)

The Canada Greener Homes Grant is no longer accepting new applications, a change that took effect in February 2024. This decision marked the beginning of a phased conclusion for the program, signalling a move away from broad-based, first-come, first-served grants. For the hundreds of thousands of Canadians who have already been approved for a grant, the final and most critical deadline is approaching.

The final date to complete all steps and request a grant payment is December 31, 2025, at 11:59 p.m. (ET). Homeowners must complete a series of time-sensitive actions by this date to ensure their application is successfully processed. The process is multi-faceted and requires careful planning:

- Pre-retrofit Evaluation: The journey begins with a pre-retrofit EnerGuide evaluation, which must be completed as soon as possible.

- Retrofit Completion: All eligible retrofits, including the installation of heat pumps or mini-splits, must be finished and paid for, with copies of all receipts retained as proof.

- Post-retrofit Evaluation: After the work is done, a post-retrofit EnerGuide evaluation is mandatory. The results from this evaluation are crucial, as they must be submitted to Natural Resources Canada (NRCan) by the service organization, a process that can take up to 30 business days. Homeowners are advised to complete this step several weeks before the December 31 deadline to account for processing time.

- Final Documentation and Request: Once the post-retrofit evaluation is processed, homeowners are notified to log into the Greener Homes portal. They must then upload all required documentation, including paid receipts, and click the final “Request the grant” button before the deadline.

The cessation of new applications and the hard deadline for existing ones have a market-wide impact. The demand for post-retrofit energy evaluations will likely see a significant increase as the year progresses and the deadline looms.

This potential bottleneck in the industry, driven by the final rush to process applications, means that homeowners who delay may be at risk of missing the final deadline, even if their retrofits are completed. This shift highlights the need for a proactive approach and a strong understanding of program timelines to avoid getting caught in the inevitable rush.

Open and Active Federal Programs

The conclusion of the CGHG does not mean the end of federal support for home energy retrofits. Two other crucial programs, the Oil to Heat Pump Affordability Program and the Canada Greener Homes Loan, remain open and are central to the new federal strategy.

The Oil to Heat Pump Affordability (OHPA) Program

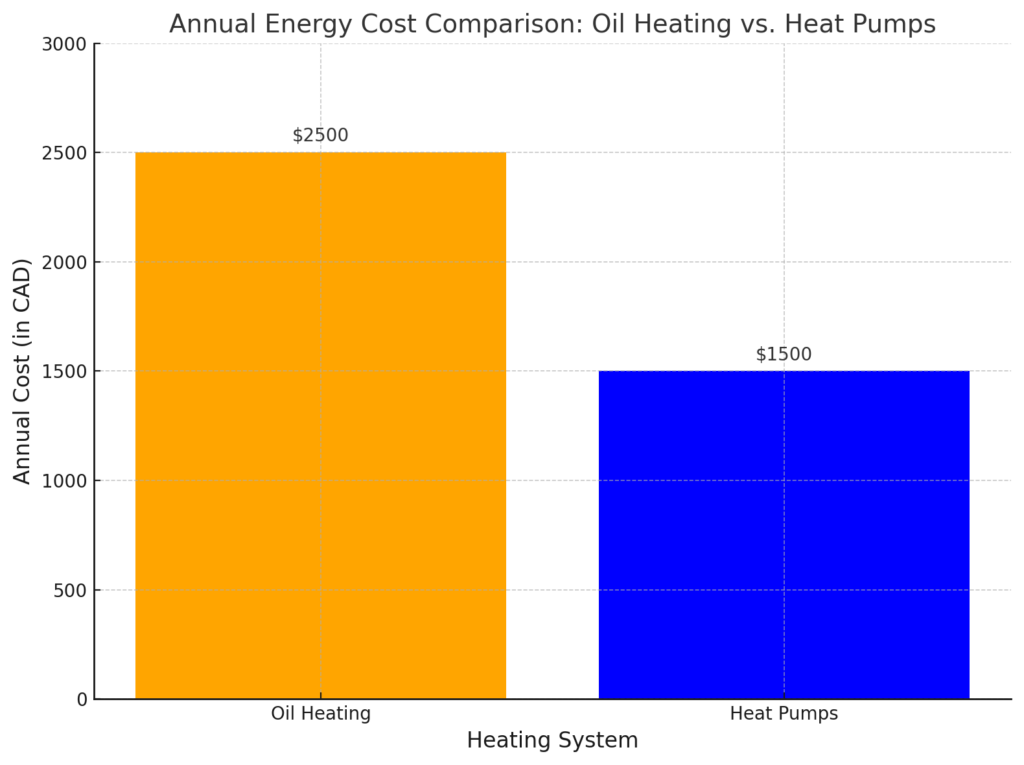

This program is the new cornerstone of the federal government’s efforts to reduce residential emissions and energy costs. The OHPA program is highly targeted, providing an upfront grant of up to $10,000 for low-to-median income Canadian homeowners who currently use oil to heat their homes.

A key, differentiating feature of the OHPA program is that it does not require a home energy evaluation, which significantly streamlines the application process and removes a potential barrier for homeowners. The funding covers the heat pump system itself, as well as associated electrical panel upgrades and oil tank removal.

The financial impact of the OHPA program is magnified significantly in jurisdictions that have partnered with the federal government on a co-delivery model. In these provinces and territories, the federal grant is enhanced with additional provincial or territorial funding, reaching a total of:

- Up to $15,000 in Nova Scotia, Newfoundland and Labrador, and Prince Edward Island.

- Up to $20,000 in Manitoba.

These co-delivery provinces also provide an additional one-time payment of $250 to further assist homeowners with the transition. The OHPA program, however, is not available in Nunavut, remote areas of Quebec, or other off-grid locations due to integrated electricity grid requirements.

The Canada Greener Homes Loan

The Canada Greener Homes Loan remains open to new applicants, providing a powerful standalone financial tool for homeowners. This program offers interest-free financing from $5,000 to $40,000 with a repayment term of 10 years. The loan is no longer combined with the Canada Greener Homes Grant, allowing homeowners to leverage it for eligible retrofits recommended by an energy advisor. The loan is a critical resource for those planning larger, more expensive retrofits that require a substantial upfront investment.

Upcoming Federal Initiatives

A new program, the Canada Greener Homes Affordability Program, is expected to be launched in the future. This program is planned to be delivered through provincial and territorial partners and is intended to help low-to-median-income households by covering the “full cost” of recommended retrofits, indicating a future where the federal government directly and fully funds deep retrofits for vulnerable populations.

The following table provides a comprehensive overview of the status of federal programs in 2025.

Table 1: Federal Rebate and Loan Programs – 2025 Status and Deadlines

| Program Name | Status | Maximum Funding Amount | Key Eligibility Criteria | Key 2025 Deadlines/Dates |

|---|---|---|---|---|

| Canada Greener Homes Grant (CGHG) | Closed to new applicants | Grants up to $5,000; up to $600 for evaluations; maximum $5,600 total | Homeowners who applied before February 2024; EnerGuide evaluation required | December 31, 2025: Final deadline to request grant payment |

| Oil to Heat Pump Affordability (OHPA) | Open for applications | Up to $10,000 (federal); up to $15,000 or $20,000 with provincial co-delivery | Homeowners with low-to-median income; must use oil as primary heat source | N/A |

| Canada Greener Homes Loan | Open for applications | Up to $40,000 | Homeowners; pre-retrofit EnerGuide evaluation required | N/A |

| Canada Greener Homes Affordability Program | Coming soon | Full cost of recommended retrofits | Low-to-median income homeowners and tenants | N/A |

Provincial and Territorial Rebate Landscape in Detail: The Fragmented Market of 2025

The end of the Canada Greener Homes Grant has left a complex, province-specific patchwork of programs. Homeowners must now navigate a landscape where incentives vary dramatically based on location, income, existing heating source, and utility provider. This section provides a detailed breakdown of the programs available in each province and territory.

British Columbia

The home energy rebate landscape in British Columbia saw significant changes in early 2025. A key update is the conclusion of the $3,000 heat pump rebate for fuel switching from natural gas, oil, or propane, which ended on April 11, 2025.

As of May 1, 2025, the focus has shifted to a new, updated rebate offer that provides up to $4,000 for homes replacing their electric heating system with a heat pump. This new offer is tiered, providing a $4,000 rebate for whole-home heating systems and a $1,500 rebate for partial-home heating systems that meet at least 50% of the heating requirements.

The province’s CleanBC Better Homes Energy Savings Program offers the most substantial rebates, providing up to $24,500 for a heat pump installation based on household income and existing fuel source. For households switching from oil, natural gas, or propane to a heat pump, the rebate can cover up to 100% of the cost for income-qualified applicants.

The program also includes a “Northern top-up” of up to $3,000 for homes in northern regions of the province.

Alberta

Alberta’s incentive landscape is defined by a combination of a provincial program and innovative municipal-level financing. The “Alberta Heat Pump Rebate” offers up to $10,000 for ground-source heat pump installations, and between $2,500 and $5,000 for cold-climate air-source heat pumps.

However, the most significant innovation in Alberta is the Clean Energy Improvement Program (CEIP), available in participating municipalities like Calgary and Edmonton. CEIP is not a rebate but a financing tool that provides homeowners with up to 100% of project costs to a maximum of $50,000 for residential properties.

The program is structured to eliminate the upfront cost barrier by adding the project costs, along with a fixed interest rate, to the homeowner’s property tax bill for repayment. This model allows the financing to be attached to the property rather than the individual owner, a notable distinction that makes the financing self-sustaining and transferable upon sale of the home.

Saskatchewan

Saskatchewan’s primary provincial incentive for energy retrofits is the Home Efficiency Retrofit Rebate (HERR) program, which is a co-delivery model with the now-closed Canada Greener Homes Grant (CGHG). This means that to be eligible for HERR, a homeowner must have been registered under the CGHG before its application closure date of February 12, 2024.

The program provides up to a maximum rebate of $2,000 for various retrofits and offers an additional $200 for the pre- and post-retrofit EnerGuide evaluations. The deadline to request the HERR rebate is directly tied to the CGHG deadline: December 31, 2025.

Separately, Saskatchewan offers a Home Renovation Tax Credit, which applies to expenses incurred on or after October 1, 2024, and can be claimed on 2025 and subsequent personal income tax returns. The tax credit can be claimed on qualified expenses in excess of $1,000, with a maximum claimable amount of $4,000 for non-seniors and $5,000 for eligible seniors.

Manitoba

Manitoba’s approach to heat pump incentives is one of the most generous in the country. The province is a co-delivery partner for the federal OHPA program, providing an additional grant of up to $5,000 on top of the federal $15,000 for a potential total of up to $20,000, plus a $250 bonus payment.

Furthermore, a new program from Efficiency Manitoba eliminates all upfront costs for the heat pump and installation. Instead, the homeowner repays the remaining 25% to 40% of the project cost gradually, with the amount added to their monthly hydro bill in a way that is designed to be less than their former energy bill. This on-bill financing model represents a powerful tool to make energy upgrades truly accessible by removing the single largest financial barrier for many households.

Ontario

Ontario has executed a seamless transition from one key program to another. The Home Efficiency Rebate program was closed to new applicants on January 27, 2025, and was immediately replaced by the Home Renovation Savings Program on January 28, 2025. This new program, a partnership between Save on Energy and Enbridge Gas, offers a wide range of rebates for energy-efficient upgrades.

For heat pumps, the rebates are substantial, offering up to $12,000 for ground-source heat pumps and up to $7,500 for cold-climate air-source heat pumps.

Homeowners can also stack these provincial rebates with federal tax credits of up to $2,000, available through 2032.

Quebec

In Quebec, homeowners can access financial assistance for heat pumps through the Hydro-Québec LogisVert Efficient Homes Program. The program provides financial assistance of up to $6,700 for the purchase of an efficient heat pump, with a bonus of 5% for those who combine at least two measures in an eligible home.

The amount of financial assistance and the list of eligible models are subject to change over time, so applicants should refer to the list in effect at the time of installation. The program also has specific deadlines; for example, financial assistance for certain measures is only available if work is completed before August 25, 2025.

Homeowners in remote areas of Quebec are not eligible for the federal OHPA program.

New Brunswick

New Brunswick has a multi-tiered approach to heat pump incentives. The province is a co-delivery partner for the federal OHPA program, providing enhanced funding for homeowners switching from oil. The NB Power Total Home Energy Savings Program offers rebates of up to $2,000 for qualifying heat pumps, and a pre-installation energy audit is required to participate.

The province also offers the Enhanced Energy Savings Program, which provides free mini-split heat pumps and insulation upgrades to low-income households with a combined gross household income of up to $70,000.

Nova Scotia

The Nova Scotia heating rebate landscape is in transition, similar to the federal framework. The Home Heating System Rebates program is winding down, with a final deadline for applications of December 31, 2025. This program offered up to $2,000 in rebates for heat pumps, but it is being replaced by more comprehensive programs that require a home energy assessment.

Nova Scotia is a co-delivery partner for the federal OHPA program, offering a total grant of up to $15,000 for eligible homeowners switching from oil heat.

Prince Edward Island (PEI)

Prince Edward Island offers a robust and layered series of incentives. The Regular Heat Pump Rebate offers up to $2,500 for a central system or $1,200 for a mini-split. For low-income households, the rebate amounts are significantly enhanced, with up to $4,500 for central systems and $2,400 for mini-splits.

The province also has a Net Zero Free Heat Pump Program, which provides free heat pumps to households earning less than $100,000 annually. As of June 2, 2025, a new point-of-sale rebate of $900 is available for eligible mini-split heat pumps, where the rebate is automatically deducted from the cost at the time of purchase. PEI is also a co-delivery partner for the federal OHPA program, with a total grant of up to $15,000 for qualifying households.

Newfoundland and Labrador

Newfoundland and Labrador provides some of the most generous incentives in the country for households switching from oil or propane. The takeCHARGE Oil to Electric Incentive Program offers up to $22,000 for income-qualified homeowners and up to $9,000 for the general stream.The program covers the cost of the heat pump, necessary electrical upgrades, and oil tank removal.

Separately, the Nunatsiavut Government offers a Residential Heat Pump Program for beneficiaries in specific communities, which can cover 75% to 100% of the cost for electric-heated homes.

Yukon

The Yukon heat pump rebate program is highly attractive and popular. The Affordable Heat Pump Program (AHPP) for low-to-median-income households can cover up to 100% of project costs to a maximum of $24,000, plus an extra $250 for those switching from oil heat.

The program is funded on a first-come, first-served basis, and in 2025, all funding was claimed within three weeks due to high demand. The Good Energy Home Heating System Rebate is available for higher-income households, offering up to 50% of costs to a maximum of $10,500 for qualifying systems.

For new homes, a separate rebate of $1,500 is available for heat pump installations. The rapid depletion of funds underscores the need for homeowners to act quickly and secure pre-approval before commencing any work.

Northwest Territories & Nunavut

The northern territories face a distinct set of challenges regarding heat pump rebates. The federal OHPA program explicitly excludes Nunavut and other remote areas due to a lack of connection to an integrated electricity grid.

In the Northwest Territories, the Arctic Energy Alliance (AEA) provides funding for renewable energy, including ground-source heat pumps, offering up to $20,000 in rebates for residents. However, as of August 6, 2025, the AEA is not accepting new applications, as it has reached its funding limit for the year, with new applications not expected to be accepted until April 1, 2026.

In Nunavut, there are no widespread, territory-wide heat pump rebate programs. The Qulliq Energy Corporation manages electricity rates and a Fuel Stabilization Rate Fund, but no specific heat pump rebates are mentioned in the provided research.

Table 2: Provincial and Territorial Heat Pump Rebates (by Jurisdiction)

| Province/Territory | Program Name | Maximum Rebate/Financing Amount | Fuel-Source Requirement | 2025 Status/Deadline |

|---|---|---|---|---|

| British Columbia | CleanBC Better Homes / BC Hydro | Up to $24,500 (income-qualified) or $4,000 (electric-heated homes) | All, with varying incentives for fuel-switching | Rebate for fuel switching ended April 11, 2025 |

| Alberta | Alberta Heat Pump Rebate / CEIP | Up to $10,000 (rebate); up to $50,000 (financing) | Varies by program | CEIP is ongoing, first-come, first-served |

| Saskatchewan | Home Efficiency Retrofit Rebate (HERR) | Up to $2,000 + $200 for evaluations | All, linked to CGHG | December 31, 2025: Final deadline to request rebate |

| Manitoba | OHPA Program / Efficiency Manitoba | Up to $20,000 + $250 bonus (OHPA); elimination of upfront costs (on-bill financing) | Oil heat (OHPA); All (new on-bill program) | N/A |

| Ontario | Home Renovation Savings Program | Up to $12,000 (geothermal); up to $7,500 (air-source) | All, with varying rebates for fuel source | Program launched January 28, 2025 |

| Quebec | LogisVert Efficient Homes Program | Up to $6,700 | All, with incentives for specific types | August 25, 2025: Work completion deadline for some measures |

| New Brunswick | Total Home Energy Savings / EESP | Up to $2,000 (THESP); free mini-splits for low-income (EESP) | All, with enhanced rebates for low-income/oil | N/A |

| Nova Scotia | Home Heating System Rebates / OHPA | Up to $2,000 (HHSR); up to $15,000 (OHPA) | All, with enhanced incentives for oil | December 31, 2025: Final deadline for HHSR applications |

| Prince Edward Island | Multiple Programs (incl. OHPA) | Up to $2,400 (mini-split); up to $4,500 (central); up to $15,000 (OHPA) | All, with enhanced incentives for low-income/oil | Point-of-sale rebates launched June 2, 2025 |

| Newfoundland & Labrador | takeCHARGE Oil to Electric / NG Program | Up to $22,000 (income-qualified); 75-100% coverage (NG) | Oil/propane (takeCHARGE); electric heat (NG) | N/A |

| Yukon | AHPP / Good Energy | Up to $24,000 (AHPP); up to $10,500 (Good Energy); $1,500 (new homes) | Fossil fuel or electric resistance heating | Program funding fully claimed within three weeks in 2025 |

| Northwest Territories | Arctic Energy Alliance (AEA) | Up to $20,000 for residents | Renewable energy sources | Not accepting applications until April 1, 2026 |

| Nunavut | Nunatsiavut Government Program | 75-100% of costs covered | Electric heat only | N/A |

Comparative Analysis and Industry Trends: Synthesizing the 2025 Landscape

The detailed program-by-program review reveals a series of overarching trends that are reshaping the Canadian heat pump market. The incentive landscape is moving beyond the simple one-size-fits-all model toward more sophisticated, financially diverse, and targeted strategies.

The Great Policy Shift

The year 2025 marks a definitive pivot away from the CGHG’s broad, multi-retrofit approach. The CGHG’s model was designed to encourage a wide range of retrofits, with a grant provided after the fact based on improvements made. The new federal cornerstone, the OHPA program, represents a surgical approach focused on a single, high-impact retrofit: switching from oil heating to a heat pump.

This new strategy prioritizes direct, measurable emissions reductions in a specific heating sector, and its upfront payment model removes a major financial barrier for low-to-median-income households.

Funding and Program Models

The diversity of funding models is a key indicator of the maturation of energy efficiency policy. Governments are experimenting with different mechanisms to make retrofits financially viable for various demographics and economic situations. The comparison of these models highlights their strategic purpose:

- Grants: Upfront subsidies, such as the OHPA program, are designed to stimulate immediate action by providing cash directly to the homeowner or contractor before work begins. This model is powerful for its simplicity and direct financial impact.

- Tax Credits: Claimed on personal income tax returns, like Saskatchewan’s Home Renovation Tax Credit, provide a financial benefit after the fact. While less immediate than a grant, they offer a consistent, long-term incentive for a wide range of renovations.

- Loans and On-Bill Financing: This model is emerging as a powerful solution to the high upfront cost of deep retrofits. Programs like the CEIP in Alberta and the new on-bill financing in Manitoba shift the financial burden from a one-time lump sum to a manageable repayment schedule. The CEIP’s ability to tie the loan to the property tax bill is a game-changer, as it allows municipalities to offer long-term financing that is not tied to the individual’s credit, and repayment is secured even if the property is sold. This approach links the long-term energy savings to the repayment mechanism, creating a financially self-sustaining model.

Table 3: The Great Rebate Pivot: A Comparison of Funding Models

| Model Type | Examples | Key Benefit | Key Disadvantage |

|---|---|---|---|

| Grants | OHPA Program, CleanBC Better Homes Energy Savings Program, etc. | Provides upfront or direct cash subsidy; immediate financial relief. | Often requires extensive documentation and can be a one-time program. |

| Tax Credits | Saskatchewan Home Renovation Tax Credit | Offers a consistent, predictable incentive over time. | Not a lump-sum, immediate payment; requires tax filing to claim. |

| On-Bill/Property Tax Financing | Alberta CEIP, new Efficiency Manitoba program | Eliminates upfront costs; repayment is low-friction and long-term. | Adds a lien or charge to the property; homeowner must be in good financial standing to qualify. |

The Demand Problem: A First-Come, First-Served Cautionary Tale

The Yukon’s Affordable Heat Pump Program and the Northwest Territories’ Arctic Energy Alliance serve as powerful case studies in the tension between generous incentives and limited funding.

Both programs, despite offering some of the highest rebate amounts in the country, were rapidly oversubscribed. In the Yukon, the 2025 funding was fully claimed within three weeks, while the AEA in the NWT stopped accepting applications until April 2026.

This phenomenon illustrates that the availability of funds for even the most attractive programs is not guaranteed and can be depleted quickly. It emphasizes that homeowners must operate with a sense of urgency, moving from an “I’ll do this next year” mentality to “I must act now” to secure funding before it is exhausted.

The Growing Importance of Utilities and Municipalities

The analysis of provincial programs demonstrates a clear shift in responsibility and delivery from the federal government to local partners. Organizations like BC Hydro, Enbridge Gas, Efficiency Manitoba, and various Alberta municipalities are no longer just passive partners but are leading the design, administration, and funding of new incentive programs.

This trend suggests a more decentralized, localized approach to energy policy, allowing for programs to be tailored to regional needs and market conditions. For the industry, this means that understanding local utility and municipal programs is now as critical as understanding the federal framework.

Actionable Insights for Content Development

Based on the synthesis of program closures, new initiatives, and market trends, the following are strategic recommendations for creating effective and timely content. The goal is to move beyond a simple list of rebates and provide a practical guide that helps homeowners navigate this complex, time-sensitive, and fragmented landscape.

- Emphasize the Final Deadline: The most critical, time-sensitive piece of information is the December 31, 2025, deadline for the Canada Greener Homes Grant. Content should be created to guide existing participants through the step-by-step process of completing their retrofit, post-retrofit evaluation, and final grant request. This is a topic of immediate relevance that can prevent homeowners from losing their funding.

- Target the New Cornerstone: The Oil to Heat Pump Affordability (OHPA) Program should be a central focus of new content. The program’s upfront payment and lack of an EnerGuide evaluation make it a compelling and accessible option for a specific demographic. Content should focus on eligibility criteria and the process of applying, highlighting the significant financial top-ups available in co-delivery provinces.

- Demystify New Financial Models: The new on-bill and property-tax-based financing models are not widely understood but are critical for making deep retrofits accessible. Content should explain how these programs work, who they benefit, and how they differ from traditional grants and loans. Using case studies from Alberta and Manitoba can help make these complex concepts more approachable.

- Acknowledge and Address the Northern Gap: The content should explicitly recognize the limited options for homeowners in the northern territories due to the ineligibility for federal programs and the oversubscription of local ones. Providing information on any existing or upcoming niche programs, or offering guidance on alternative options like the Canada Greener Homes Loan, can provide value to this underserved demographic.

- Leverage Urgency and Scarcity: The high demand for programs in the Yukon and Northwest Territories provides a powerful lesson. Content can use these examples to create a sense of urgency, advising homeowners to check for funding availability and act quickly, particularly for first-come, first-served programs.

- The Professional Advantage: The fragmentation of the market and the complexity of requirements underscore the importance of professional advice. Content should consistently reinforce the value of working with certified contractors and energy advisors who can navigate the nuanced eligibility requirements and ensure the installation meets all program standards.

Conclusion: A Look Beyond 2025

The research reveals that the year 2025 is not simply a footnote in the history of Canadian energy policy but a pivotal moment of transition. The end of the Canada Greener Homes Grant and the rise of targeted programs signal a fundamental shift in the government’s approach.

The new landscape is characterized by its strategic focus on specific, high-impact retrofits and its use of innovative financial tools to remove the barrier of high upfront costs.

The trend toward decentralization, with utilities and municipalities taking a greater role in program delivery, is also becoming increasingly evident. For homeowners and industry professionals, the era of a single, simple grant is over.

Success in the new market will be defined by a deep, nuanced understanding of a complex, fragmented, and geographically diverse array of programs, where planning, swift action, and professional guidance are paramount.